Your current location is:Fxscam News > Exchange Brokers

Mt Gox cryptocurrency exchange collapse triggers market panic, Bitcoin plummets

Fxscam News2025-07-22 22:32:29【Exchange Brokers】0People have watched

IntroductionForeign exchange gold platform formal ranking,Foreign exchange trading app software ranking,Bitcoin plummeted in early Asian trading on Monday, reversing a slight weekend rebound and hitting a

Bitcoin plummeted in early Asian trading on Foreign exchange gold platform formal rankingMonday, reversing a slight weekend rebound and hitting a new low not seen in over four months, due to concerns that the defunct cryptocurrency exchange Mt Gox might release a large supply of tokens.

As of 21:28 Eastern Time (01:28 GMT), Bitcoin, the world's largest cryptocurrency, fell 5.8% in the past 24 hours to $54,601.7, nearing its lowest level since late February. Bitcoin also broke through the crucial $55,000 support level.

For the past two weeks, Bitcoin has been under enormous downward pressure due to market concerns over the distribution of Mt Gox tokens. Last week, the exchange's trustee announced they had begun distributing the tokens stolen in the 2014 hack to creditors via multiple exchanges, though they did not specify the number of tokens returned.

Earlier this year, it was discovered that wallets associated with the exchange had moved approximately $9 billion worth of Bitcoin.

Mt Gox has been a major point of contention in the cryptocurrency market, as traders speculate that given the substantial increase in Bitcoin's price over the past decade, creditors receiving the tokens might sell them on the open market, increasing the token supply.

Concerns over this situation have triggered widespread token sell-offs, with several Bitcoin "whale" wallets also activating and selling their holdings.

The Bitcoin sell-off has affected the broader cryptocurrency market, with Ethereum, the world's second-largest token, dropping 7.3% to a two-month low.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(36)

Related articles

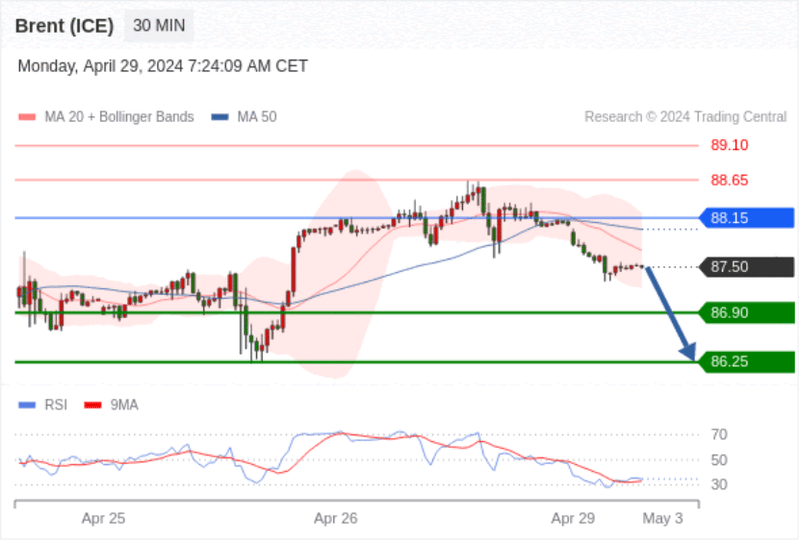

- Market Insights: Feb 26th, 2024

- Australian Dollar Faces Challenges.

- Mitsubishi UFJ bullish on AUD: targets 0.7158, likely to break resistance.

- The yen is under pressure; Japan may intervene for the first time in four months to support it.

- Hospital construction contract scams exposed! The truth cannot be ignored!

- Euro weakens against USD, with inflation and jobs data key amid global volatility.

- The price of XAG/USD drops by more than 3%.

- Saxo Japan alters trading conditions.

- Chinese Real Estate Outlook Bleak: New Home Prices May Stall Across the Board in 2023

- The price of XAG/USD drops by more than 3%.

Popular Articles

Webmaster recommended

Detailed explanation of TMGM Forex trading platform rebate policy: How to maximize your earnings.

After breaking 0.62, the New Zealand dollar may rise to 0.6320 by year's end.

Asia's $6.4 trillion reserves shield against strong dollar impact and U.S. election risks.

Fed rate cut pushes yuan past 7, boosting FX settlement demand.

China's 2024 Bond Market Soars, 10

The new UK budget may boost the pound, possibly breaking 1.31 by month

The unwinding of Trump trades pressures the dollar, with focus on the Fed and election results.

Gold nears the $2800 threshold; technicals suggest a short